Starting a business is an exciting journey, but one of the biggest hurdles many founders face is securing funding. Navigating the complex world of finance can be daunting, but with the right strategies and insights, you can overcome these challenges. Here are some expert tips to help you on your way.

Understanding the Funding Landscape

The funding landscape is diverse, and understanding the various types of funding and stages involved is crucial for any startup founder.

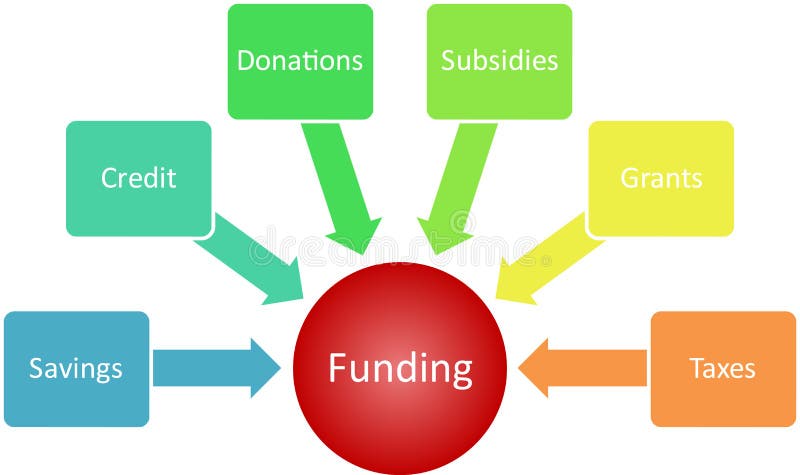

Types of Funding

Bootstrapping

Bootstrapping involves using your own savings or revenue from the business to fund operations. It’s a great way to maintain control, but it may limit your growth speed. Learn more about bootstrapping your startup from Forbes.

Angel Investors

Angel investors are individuals who provide capital for startups in exchange for ownership equity or convertible debt. They are often willing to take more risks than traditional investors. For insights on working with angel investors, check out this guide from Entrepreneur.

Venture Capitalists

Venture capitalists (VCs) are professional groups that manage pooled funds from many investors. They invest in startups with high growth potential, typically in exchange for equity. Harvard Business Review offers a detailed look at securing VC funding.

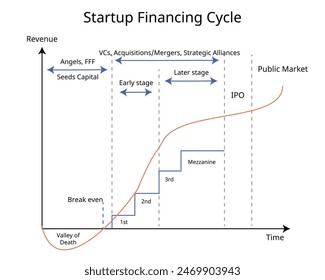

Stages of Funding

Seed Stage

This is the initial funding used to start a business, covering costs like market research and product development.

Series A, B, and Beyond

As your startup grows, you may seek additional rounds of funding, known as Series A, B, C, etc., each serving different purposes and growth stages. Understanding the different funding stages is key.

Preparing for Funding

Before approaching investors, you need to be well-prepared. This involves crafting a compelling pitch and building a robust business plan.

Crafting a Compelling Pitch

Your pitch should tell a compelling story about your startup, highlighting the problem you solve, your unique solution, and the market potential. Be concise and passionate.

Building a Strong Business Plan

A solid business plan outlines your business model, market analysis, financial projections, and growth strategies. It shows investors that you’ve thought through every aspect of your business. Inc. provides an excellent guide on writing a business plan.

Building Relationships with Investors

Investors are more likely to fund startups with whom they have strong relationships. Building these connections takes time and effort.

Networking Strategies

Attend industry events, join startup incubators, and use platforms like LinkedIn to connect with potential investors. Networking is about building genuine relationships, not just making a sale.

Leveraging Mentorship

Find mentors who can introduce you to investors and offer valuable advice. Their endorsement can significantly boost your credibility.

Common Funding Challenges

Funding is never a straightforward path, and you’ll likely face several challenges along the way.

Overcoming Rejection

Rejection is part of the process. Use feedback from investors to refine your pitch and business plan. Persistence is key.

Managing Equity and Control

Balancing the need for funding with retaining control over your startup can be tricky. Be mindful of how much equity you give away and seek legal advice when necessary.

Alternative Funding Options

If traditional funding routes are not working, consider alternative options.

Crowdfunding

Platforms like Kickstarter and Indiegogo allow you to raise small amounts of money from a large number of people. It’s also a great way to validate your product.

Government Grants and Loans

Many governments offer grants and loans to support startups. These can be a valuable source of non-dilutive funding.

Practical Tips for Sustaining Your Startup

Once you secure funding, it’s crucial to manage it wisely to sustain and grow your business.

Budgeting and Financial Management

Create a detailed budget and monitor your expenses closely. Financial discipline is critical for long-term success.

Scaling Smartly

Grow at a pace that matches your resources. Overexpansion can strain your finances and operational capacity.

Conclusion

Securing funding is one of the most challenging aspects of building a startup, but with determination, preparation, and the right strategies, you can navigate this landscape successfully. Remember to leverage your network, seek out mentorship, and remain adaptable in your approach.

FAQs

How can I improve my pitch to investors?

Focus on telling a compelling story, be clear about your market potential, and practice delivering your pitch confidently.

What should I include in my business plan?

Include your business model, market analysis, financial projections, and detailed growth strategies.

How do I find the right investors for my startup?

Network at industry events, use online platforms and seek referrals from mentors and other founders.

What are some common mistakes to avoid when seeking funding?

Avoid being unprepared, failing to understand your market, and giving away too much equity too soon.

How can I use alternative funding sources effectively?

Research your options thoroughly, create a compelling campaign for crowdfunding, and ensure you meet the criteria for government grants and loans.

Leave a Reply